Conversational Agents for Older Adults (CA4OA)

Conversational Agents for Older Adults (CA4OA)

Trustworthy conversational agents (CAs) can help older adults (OAs) as a flexible means to access basic services such as online banking where the shift to CAs is fast. However, OAs tend not to adopt CAs due to the lack of trust and cannot benefit from them. Consequently, OAs may become digitally marginalised and excluded from digitalised society. It is timely to study with interdisciplinary approaches how design choices of CAs (modality, embodiment, anthropomorphism) and OAs’ mental models, attributes (e.g., gender) and conditions (e.g., loneliness) are related to trust in CAs. Design guidelines and prototypes for OA-specific CAs will be delivered.

CA4OA is a research project funded by UKRI Trustworthy Autonomous Systems (TAS) Hub, and is closely linked to the UKRI Verifiability Node of which Durham University is one of the key partners.

Project Team

- PI: Professor Effie Lai-Chong Law, Department of Computer Science

- CoI: Dr. Thuy-Vy Nguyen, Department of Psychology

- CoI: Dr. Felix Irresberger, School of Business

- Postdoc RA: Dr. Farkhandah Komal, Department of Computer Science

- Partner: Age UK Teesside

- Partner: Atom Bank

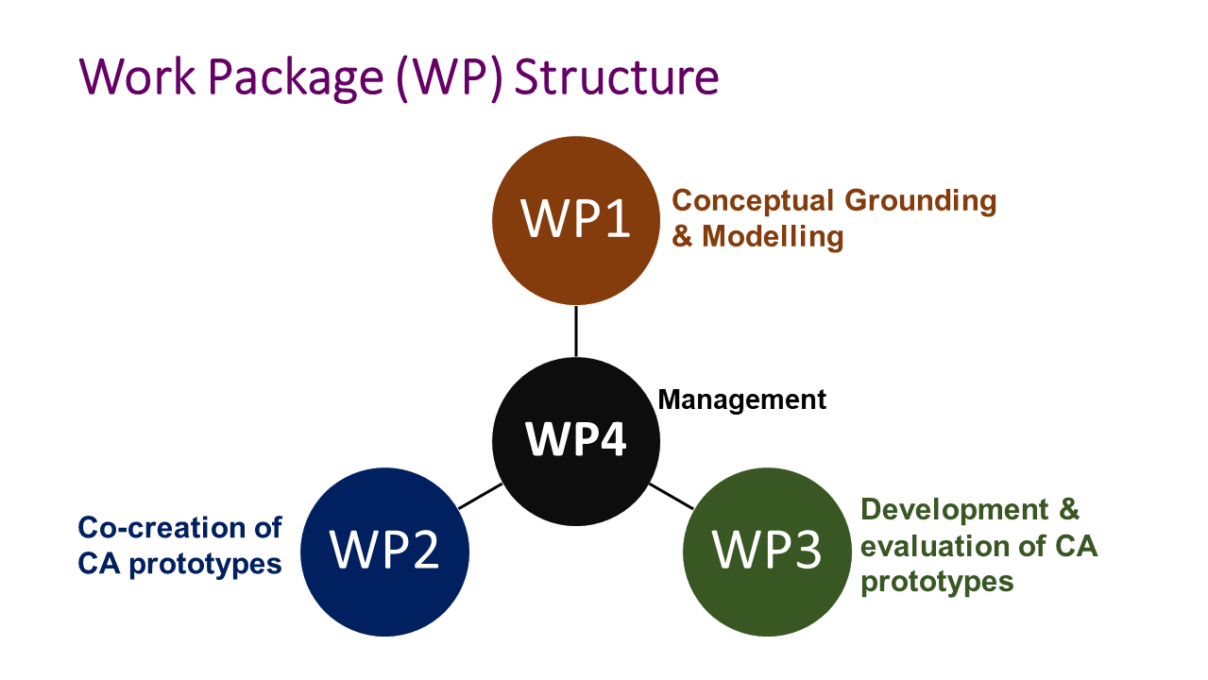

Project Aims & Structure

- Aim 1: Identifying evidence-based design guidelines for older adult-specific CAs.

- Aim 2: Developing deep understandings of how older adults’ attributes and conditions, especially loneliness, impact trust in CAs, and how older adults’ attitudes towards AI-based autonomous systems may change through actual contacts with them.

- Aim 3: Empowering older adults to calibrate trust in CAs by designing appropriate explanations (XAI) as well as risk alerts contingent on CAs’ behaviour and performance.

Project Blog

Banking Chatbots for You? Hmm… I am still considering!

Have you ever wondered how many physical bank branches have closed in the UK each month since 2015? The answer is a staggering 54, and this number is on the rise. This trend can be attributed to the rapid growth of online banking services and the broader fintech industry. While these developments bring convenience to many, they have left technology-naïve bank customers with few alternatives, forcing them to navigate online banking platforms often powered by AI-driven conversational agents, commonly known as chatbots.

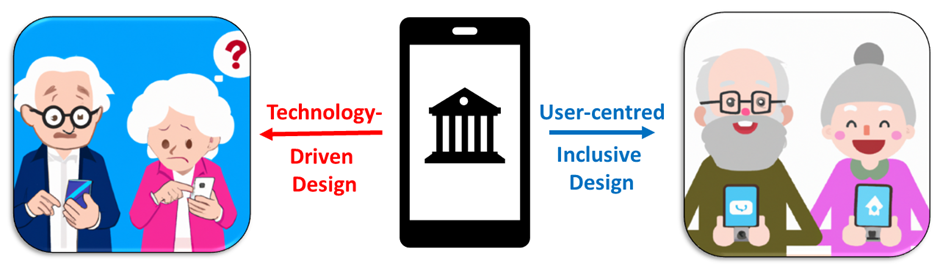

Research indicates that older adults, aged 65 and above, are more likely than their younger counterparts to resist the digitalisation of customer services, particularly in the realm of banking. One of the primary factors contributing to this resistance is a lack of trust in new technology in general, exacerbated by concerns and uncertainties surrounding AI. This lack of trust can have significant consequences. On one hand, it may result in underutilisation or avoidance of AI applications that could substantially enhance the quality of life. This digital hesitancy can lead to exclusion from the benefits of technology and participation in society, potentially marginalising older adults further. On the other hand, misplaced trust or overreliance on AI applications, especially for critical services like banking, can expose individuals to severe risks such as financial loss and psychological harm. Striking the right balance in trusting AI applications is a challenging endeavour.

To address these challenges, our research project, Conversational Agents for Older Adults (CA4OA), focuses on inclusive design to ensure that online banking chatbots are not only usable but also instill an optimal level of trust in older users. We employ the User-Centred Design (UCD) approach, which involves actively engaging representative end-users throughout the development process, capturing their requirements, and gathering feedback on design artefacts and prototypes. In addition to UCD, we apply inclusive design principles to align the features of the banking chatbot with older adults’ needs and preferences.

Our research includes practical testing. We have developed an interactive banking chatbot prototype and conducted tests with 19 participants aged from 65 to 77 years old (average age: 70.3). Eight participants were female and eleven were male. The testing was conducted with the university’s ethics approval. Each participant was asked to download the chatbot onto their own mobile phone and carry out the task of money transfer with fictitious bank account information. For security and privacy concerns, no real personal data were involved. The results were mixed, with some participants appreciating the user-friendly interface and ease of use, while others provided valuable feedback on the chatbot’s voice quality, font size, and service scope. We are actively addressing these comments to improve the chatbot’s design.

As trust is highly context-dependent, our research also explores the impact of the application domain on older adults’ trust in chatbots. While banking is a trust-critical context, we are investigating the use of chatbots for entertainment purposes, which may be less trust-critical. To understand older adults’ willingness to adopt chatbots for music appreciation, we are conducting an exploratory survey on this specific topic.

Our research journey is ongoing, and our next milestones in the coming months will include:

- Continuously improving the banking chatbot prototype based on user feedback.

- Developing a new chatbot prototype for music appreciation.

- Comparing data-driven trust models across the two application domains to better understand how trust operates in different contexts.

In summary, our research project CA4OA is dedicated to enhancing trust and usability in online banking chatbots for older adults, ensuring they can confidently embrace the digital age while staying safe and informed.